SAGE MOUNTAIN 945 East Paces Ferry Rd NE, Suite 2660, Atlanta, GA 30326

Sage Mountain Research

Market Update – 1st Half 2022

Key Points

- Several factors pressured both stocks and bonds in the first half of 2022, resulting in a particularly difficult period for “60/40” style portfolios.

- At present, financial markets are focused on inflation readings and the Fed’s potential reaction to them.

- Supply chain issues, business inventory levels, and a rapid policy normalization will likely mean both the economy and financial markets will be unusually volatile.

- Financial markets likely have priced in a mild to moderate recession. Barring additional surprises in inflation or in economic weakness, markets could be settling down by year-end.

Market Snapshot

Markets continued to fall in the second quarter. The major building blocks of most investors’ allocation– global equities and investment grade fixed income both fell sharply. Gold fell during the quarter and commodity-linked equities came off the boil (the SPDR Energy Sector ETF was down 17% in June). Credit spreads widened, reflecting recession fears.

However, most of the bond damage came from duration. The sudden spike in interest rate expectations meant losses on existing bond holdings, as the Fed flipped firmly into inflation fighting mode. At the Fed, talk of transitory inflation is out and communicating a tough stance on inflation is in. The Fed has every incentive to scare the markets in order to reestablish stable inflation expectations. Paradoxically, by sounding tough, the Fed is less likely to need to continue acting tough in 2023.

The Current Environment

Beginning with some good news, the overall impact of COVID-19 continues to fade. Unemployment is low and hiring demand is still strong. Valuation declines now put both stocks and bonds in a better position to outperform going forward. Partly, this is because price declines have far outpaced earnings revisions lower. Analysts are often late to lower their numbers, but the gap is wider than normal, suggesting companies (who are providing analysts guidance) are less pessimistic than the market. Currently, consensus estimates for S&P 500 EPS growth in 2022 are positive 8%. Rising wages and the strong dollar may push this lower, but so far we just don’t seem to be setting up for a 2000 or 2008 style recession.

By this point, the bear case is well known. Russia’s grinding invasion of Ukraine continues, disrupting the agricultural and energy markets. China may be close to altering its zero Covid policy, but for now renewed lockdowns remain a risk to both global supply chains and to demand. Most obviously, the Federal Reserve is hawkish, raising interest rates by 0.75% in June and promising further tightening in the months ahead. High inflation and Fed tightening have combined with greater risk aversion to tighten financial conditions. These factors, combined with the end of extraordinary pandemic aid, have resulted in record-low consumer sentiment. Markets have been disorienting in part because investors have moved from primarily fearing inflation to now fearing both inflation and recession simultaneously. Curbing inflation required a prolonged period of high rates in the 1970s, and investors are likely extrapolating some of these 1970s fears to today. We note two factors: 1. GDP growth is much less energy intensive today than back then and 2. While the Fed may have been too slow to get started, it shifted far more quickly to inflation fighting than in the past. Despite the inflation data through June, there are signs inflation will ease with commodity prices dropping 16% over the past month, an increase in inventories which could lead to future price cuts, higher mortgage rates slowing the growth of home prices, and decelerating wage growth. Futures markets are showing the expectation the Fed cuts rates in 2023.

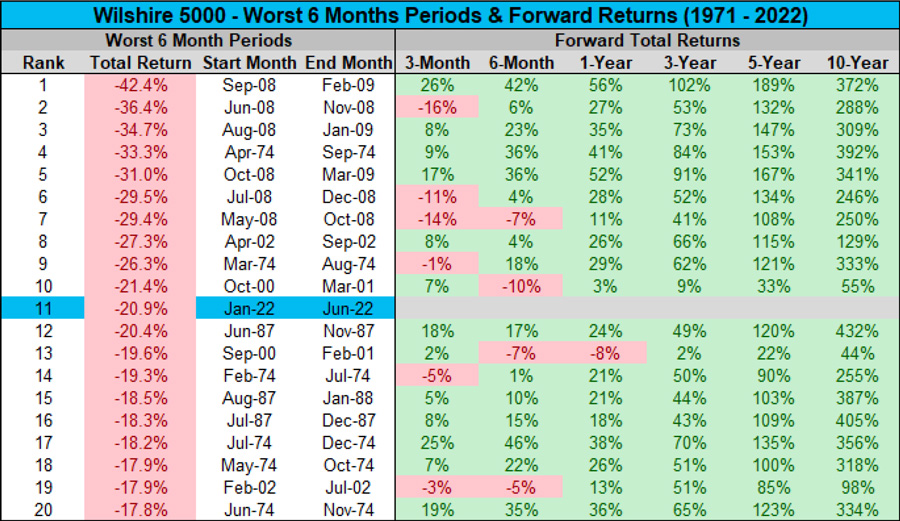

Charlie Biello of Compound advisors created a table of the worst 6 month periods from 1971 until now. The current market downturn ranks about the middle of the pack (so far). Based on this “naïve” data (not trying to take varying environments into account), more often than not, the next 6 month and later periods posted very strong returns.

While no one can predict the market, it’s worth remembering that things will look different a couple of quarters from now. Supply chains will continue to detangle. The economy will be about to lap the period where inflation first took off, exacerbated by Russia’s invasion of Ukraine. China may have a more efficacious or balanced COVID policy. While midterm election campaigning will be in full swing, the likely outcome — gridlock — means corporate tax rates are unlikely to rise. China has also begun a stimulus program, recently announcing a large $220 billion local bond issuance program to be spent on infrastructure. These items may cushion what has been a jarringly sudden slowdown as engineered by the Fed.

Asset Allocation

What does this mean for portfolios? Recent events continue to highlight the need for enhanced diversification. Stock and bond portfolios are vulnerable when rising inflation hurts both. Floating rate loans, real estate, and other alternative investments can provide additional diversification. We have recommended that our clients limit duration in their fixed income portfolios, avoid high yield corporate bonds, and allocate a portion of their portfolios to alternative asset classes which have been prudent moves so far this year. Going forward, while we believe investors should continue to hold investment grade fixed income as a hedge against recession fears, we continue to see little benefit to taking on additional interest rate risk given the relatively flat shape of most yield curves (i.e. you don’t get paid to take additional duration risk). High yield bonds now look more attractive as spreads have widened significantly, and are evaluating opportunities to selectively add exposure. Alternative assets like direct lending and real estate may provide a hedge against inflation. A diversified portfolio of direct loans has returned 2.5% year to date through June (as measured by the return of the Cliffwater Corporate Lending Fund), outperforming the public S&P Leveraged Loan Index which was down 4.6% over the same period. Using the BlueRock Total Income+ Real Estate Fund as a proxy, private real estate has returned 14.4% year to date, while the FTSE/NAREIT index of publicly traded REITs was down 20.7%. For investors with a high risk tolerance and long time horizon, we believe sectors like biotech and enterprise software may offer a good buying opportunity, although there will likely be periods of volatility and negative returns.

Given how volatile the current environment is and the inherent uncertainty in predicting economic and financial market outcomes, we recommend avoiding making drastic changes based on one’s outlook. History has shown that there will always be reasons for caution and concern, but the penalty for missing even a few of the best days in the equity market is steep. It is essential that investors avoid excessive concentration and leverage, or otherwise taking too much risk which might cause them to abandon their long-term strategy during a difficult time, because staying disciplined through down markets (and, conversely, not chasing the hot investment in up markets) has proven to be a winning strategy through many market cycles.

We continue to monitor economic data regarding inflation, signs of a softening labor market, earnings revisions, and high yield debt spreads. While the odds of a recession are increasing given the Fed’s commitment to raising rates, we believe returns so far this year indicate that markets have already priced in a lot of forward looking bad news. To wit, the S&P 500 was down 20% in the first half while earnings grew and the US added over 2.7 million jobs.

Please reach out to your Wealth Advisor with questions or to discuss any of these topics. Thank you again for your trust and partnership, especially in these turbulent times.

Russ Allen

Director of Investment Strategy

Sage Mountain

Tony Cox

President & Chief Investment Officer

Sage MountainPast performance is not indicative of future results. Please see the disclosures below.

Past performance is not indicative of future results. Sage Mountain Advisors, LLC (“SMA”) is an independent SEC registered investment advisor. Any reference to or use of the terms “registered investment adviser” or “registered,” does not imply that SMA or any person associated with SMA has achieved a certain level of skill or training. This material is provided for informational and educational purposes only.

Any subsequent, direct communication by SMA with a prospective client shall be conducted by a representative that is either registered or qualifies for an exemption or exclusion from registration in the state where the prospective client resides. For more information pertaining to the registration status of SMA, please contact SMA or refer to the Investment Adviser Public Disclosure website (www.adviserinfo.sec.gov). The information contained herein should not be construed as personalized investment, tax, or legal advice. Certain information contained in this presentation has been derived from third party sources. While we believe these sources to be reliable, we make no representations as to the accuracy, timeliness, and completeness of any such information prepared by any unaffiliated third party incorporated herein, and take no responsibility therefore. As such, there is no guarantee that the views and opinions expressed in this presentation will come to pass.

All investments carry a certain degree of risk of loss, and there is no assurance that an investment will provide positive performance over any period of time. The statements contained herein reflect opinions, estimates and projections of SMA as of the date hereof, and are subject to change without notice. SMA reserves the right to modify its current investment strategies and techniques based on changing market dynamics or individual portfolio needs. The opinions expressed herein are those of SMA and are subject to change without notice. Information presented should not be considered as a solicitation or recommendation to buy or sell any security, financial product, or instrument discussed herein. Additionally, this material contains certain forward-looking statements which point to future possibilities. Due to known and unknown risks, other uncertainties and factors, actual results may differ materially from the results portrayed or implied in such forward-looking statements. Furthermore, the illustrative results presented in this presentation in no way reflect the performance of any SMA product or any account of any SMA client, which may vary materially from the results portrayed for various reasons, including but not limited to, investment objectives, financial situations and financial needs of SMA clients; differences in products and investment strategies offered by SMA; and other factors relevant to the management of SMA client accounts. This presentation and its contents are provided “as is” without warranty of any kind, express or implied, including, but not limited to, implied warranties of merchantability, fitness for a particular purpose, title, non-infringement, security, or accuracy. SMA reserves the right to modify its current investment strategies and techniques based on changing market dynamics or client needs. It should not be assumed that any of the security transactions, holdings or sectors discussed were or will prove to be profitable, or that the investment recommendations or decisions we make in the future will be profitable or will equal the investment performance of the securities discussed herein.

Actual investment advisory fees incurred by clients may vary. A complete description of SMA’s fee schedule can be found in Part 2 of its FORM-ADV which is available at www.sagemountainadvisors.com or by

calling (404) 795-8361. Clients are advised that no portion of the services provided by SMA should be interpreted as legal, tax or accounting advice. For legal and tax-related matters, we recommend that you seek the advice of a qualified attorney, accountant or tax professional. SMA-22-000321